Artificial Intelligence, Modern Workflows, Technology

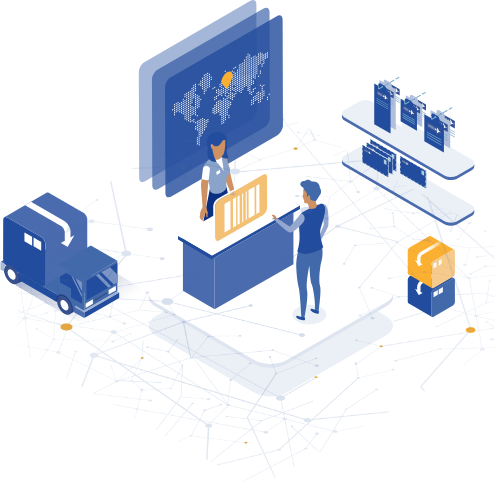

Operationalizing Intelligent data-driven systems

Improve ROI by building more intelligent systems that help you understand every facet of your operation.

Our unique software platform powers the world’s first and last-mile deliveries, helping Posts connect nearly 1 billion consumers with global eCommerce networks

Riposte is Escher’s award-winning platform, specifically designed for Posts, is unmatched in its reliability, durability, extensibility and scalability. Riposte’s open architecture ensures Posts are not locked into specific components, services, technical architecture or hardware. The solution easily integrates with existing applications and systems and can quickly expand to enable Posts to pivot and adapt to new services, channels, markets, business models and technologies. Riposte offers unparalleled flexibility, enabling the addition, removal or replacement of components to support evolving needs.

Learn More

The Riposte Customer Engagement Platform has a wide selection of off-the-shelf applications built specifically for Posts. Customized to each individual implementation, these Standard Business Applications (SBAs) enable posts to deal with common business scenarios and workflows right out of the gate.

Learn More

Riposte Customer Engagement Platform supports multiple channels while providing a seamless customer and user experience on any software environment running Windows, Android, or iOS operating systems and on any form factor device. Escher enables Post Office to provide a wide variety of customer channels – including PUDO, mobile app, kiosks and counter, increasing customer satisfaction, engagement, and experience.

Get the most from your Riposte implementation, with support and training tailored to your needs.

Best practice assistance to migrate to the latest version of Riposte.

Learn More

Specialized analysis of your Riposte environment & infrastructure providing practical advice from both a business and technical perspective.

Learn More

By submitting the form, you are consenting to the terms of our Privacy Policy

Escher is committed to protecting and respecting your privacy, and we’ll only use your personal information to administer your account or to provide relevant content. You can unsubscribe anytime.